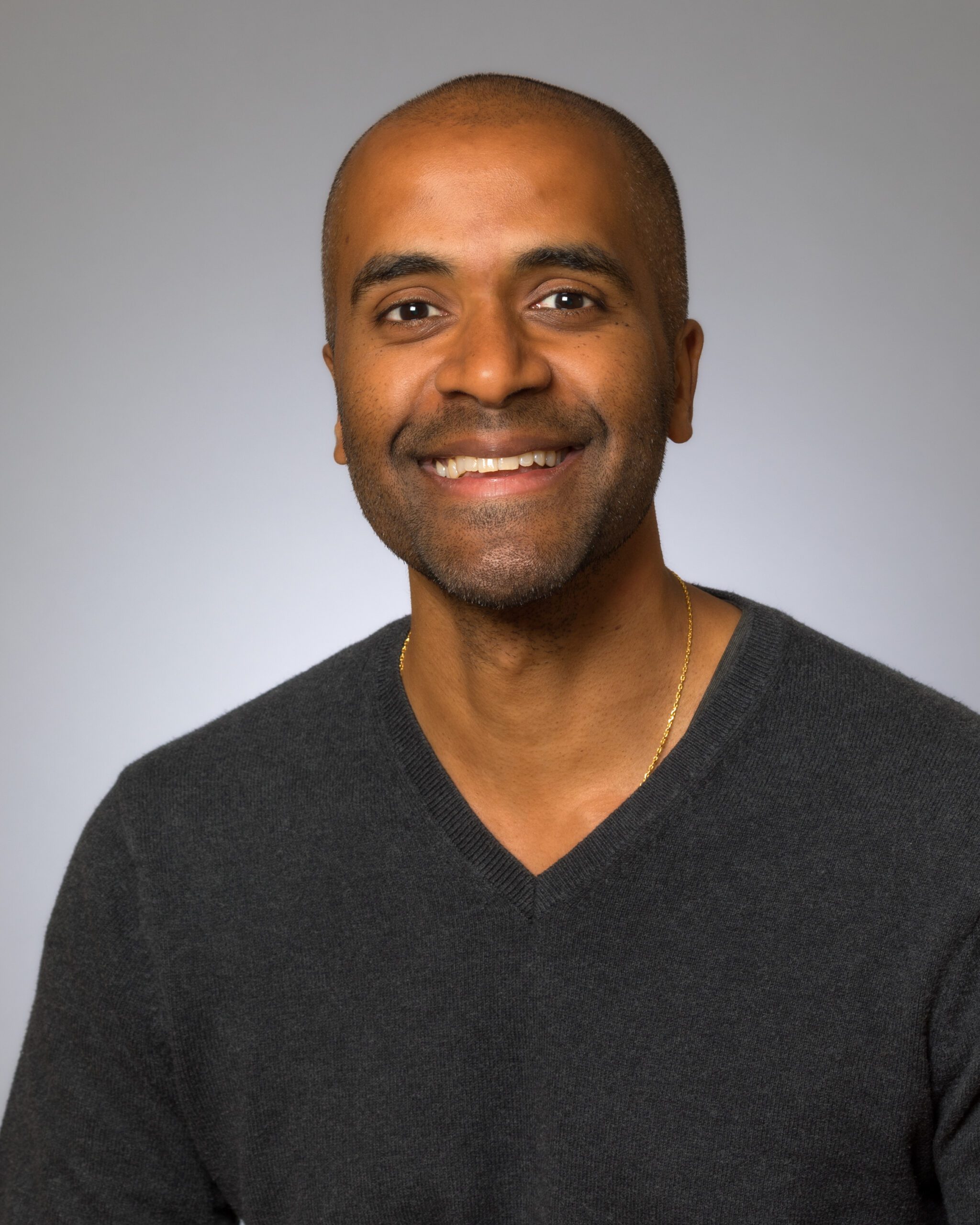

Manoj Viswanathan

Joseph W. Cotchett '64 Professor of Law and Co-Director, UC Law SF Center on Tax Law

- Office: 314-200

- Email: viswanathanm@uclawsf.edu

- Phone: (415) 565-4694

Bio

Professor Manoj Viswanathan teaches doctrinal tax courses, tax-focused clinical courses, and courses in contract law. His research focuses on tax policy, inequality, and tax-exempt organizations.

Prior to UC Law SF, Viswanathan was a clinical teaching fellow and lecturer at Yale Law School, where he co-taught the Community and Economic Development clinic, and worked as a tax associate with Skadden, Arps, Slate, Meagher, & Flom LLP’s New York City office.

He received his J.D. and LL.M. degrees from New York University School of Law, and undergraduate and graduate degrees from the Massachusetts Institute of Technology.

Education

-

New York University School of Law

LL.M., Law -

New York University School of Law

J.D., Law -

The Massachusetts Institute of Technology

S.M., Chemical Engineering -

The Massachusetts Institute of Technology

S.B., Chemical Engineering -

The Massachusetts Institute of Technology

S.B., Physics

Accomplishments

-

Rutter Award for Teaching Excellence

Award honors outstanding professors at California’s top law schools. 2020 -

Geoffrey Hazard Junior Faculty Research Award

2019 -

Judge Rose L. & Herbert Rubin Law Prize

Awarded for most outstanding note for the NYU Law Review in international, commercial, or public law. 2007 -

1st place, Federal Bar Association Section of Taxation Writing Competition

2007 -

1st place, Tannenwald Competition for Excellence in Tax Scholarship

2006

Selected Scholarship

-

Implementing a (Modern) Progressive Consumption Tax (Forthcoming)

Virginia Tax Review 2022 -

Retheorizing Progressive Taxation (Forthcoming)

Tax Law Review 2022 -

Corporate Behavior and the Tax Cuts and Jobs Act

Nicholas H. Cohen and Manoj Viswanathan, U. Chi. L. Rev. Online (2020) -

Lower-Income Tax Planning

Manoj Viswanathan, 2020 U. Ill. L. Rev. 195 2020 -

The Qualified Small Business Stock Exclusion: How Startup Shareholders Get $10 Million (or more) Tax-Free

Manoj Viswanathan, 120 Colum. L. Rev. F. 2020 -

Hyperlocal Responses to the SALT Deduction Limitation

71 Stan. L. Rev. Online 294 2019 -

The Games They Will Play: Tax Games, Roadblocks, and Glitches under the 2017 Tax Legislation

(with David Kamin, David Gamage, Ari Glogower, Rebecca Kysar, Darien Shanske, Reuven Avi-Yonah, Lily Batchelder, J. Clifton Fleming, Daniel Hemel, Mitchell Kane, David Miller, and Daniel Shaviro), Minnesota Law Review 2019 -

Caveat IRS: Problems with Abandoning the Full Deduction Rule,

(with Joseph Bankman, David Gamage, Jacob Goldin, Daniel Hemel, Darien Shanske, Kirk J. Stark, and Dennis J. Ventry, Jr.), Special Report, Tax Notes 2018 -

From Business Tax Theory to Practice

(with Alina Ball), Clinical Law Review 2017 -

Tax Compliance in a Decentralizing Economy

Georgia State Law Review 2017 -

The Hidden Costs of Cliff Effects in the Internal Revenue Code

University of Pennsylvania Law Review 2016 -

Form 1023-EZ and the Streamlined Process for the Federal Income Tax Exemption: Is the IRS Slashing Red Tape or Opening Pandora's Box?

University of Pennsylvania Law Review Online 2014 -

Sunset Provisions In The Tax Code: A Critical Evaluation and Prescriptions For The Future

New York University Law Review 2007